Retirement Planning

Tailored Advice to Support Your Retirement

Planning for retirement is one of the most important investments you’ll ever make. Our retirement planning services combine a mix of financial advice to help you get the income you need by managing your money, super and investments so that you can live the life you deserve.

Retirement Planning for a Secure Future

It’s common to be concerned about your future and financial security when thinking about the prospect of retirement. Like any new chapter in life, a little preparation can go a long way, and our retirement planning services can help you move onto the next stage with a sense of freedom and control.

Your retirement age isn’t set in stone. You can retire whenever you are in a position to support yourself. However, your health, financial situation, employment opportunities, individual preferences and partner’s needs could all play a big part in your decision.

Agile Wealth can help you:

- Invest specifically for retirement

- Establish sustainable income streams

- Plan for things like travel plans and medical expenses

- Determine whether you’re ready to retire and support your needs

- Assess your eligibility for concessions

- Assist with age pension assessment and opportunities to increase what you receive

How Much is Enough to Retire?

The current guidelines suggest $69,691 is the minimum yearly income that’s required to keep a couple living in comfort in your own home during retirement. That figure won’t work for everyone though, so you need to understand your living expenses when investing for your retirement. Whatever your retirement plans look like, Agile Wealth can design retirement advice so you always know what is sustainable for you, your partner and your family.

Modest Lifestyle

Single

$31,323

Couple

$45,106

Comfortable Lifestyle

Single

$49,462

Couple

$69,691

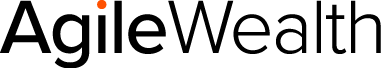

Our Retirement Planning Strategy

The amount of money you’ll need in retirement is a very personal thing. It’s also the best place to start with retirement planning. Our team will sit down with you to determine your lifestyle needs, daily budget and what you want to set aside in your “slush fund” so you can enjoy your retirement.

Once we know that, we can develop cash flow plans for your retirement that give you peace of mind and put you in control of your needs and spending habits.

Agile Wealth designs cash flow plans to help you achieve a balance between your current lifestyle and your needs in retirement. If it’s suitable for your situation, we can also help you establish an investment strategy so that your money is working for you. That way, the profits will be waiting, and they’ll be yours to enjoy when you retire.

Agile Wealth will help you:

Determine the sustainability of your lifestyle goals

Find the balance between your current income and growing your retirement

Manage your ongoing risk and the stewardship of your money in retirement

What Our Clients Say

When you invest, money fluctuates up and down due to the risks involved. In retirement though, your investments should be built for purpose. Agile Wealth will help you find the right balance of risk in your retirement investments. That means your money will move steadily and help you sustain your lifestyle goals.

We help you identify your real goals and objectives so you can dare to dream.

Contact Us Today

Now is the best time to take control of your finances and plan for the future. Contact Agile Wealth today to make an appointment with our professional financial advisors.