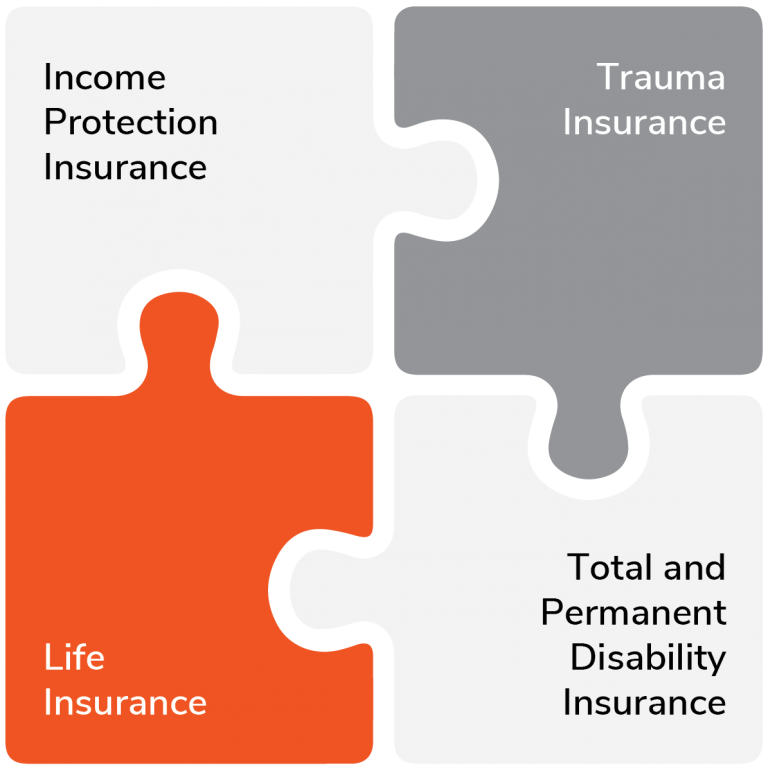

Protect Your Greatest Assets with Personal Insurance

Your personal insurances play a central role in your financial strategy. We cannot stress enough how important it is to have your insurance policies in order.

Consider your future. What happens if you can’t work or earn an income? Having the right personal insurances in place can secure your financial future when you need it most. Whatever stage of life you’re at, Agile Wealth can help you navigate the world of insurance and choose policies that will protect you, your family and your businesses.

Your personal insurance is an asset that:

- Acts as a safety net, protecting your wellbeing and financial future

- Ensures your family is taken care of if something goes wrong

- Provides for you and your family if you can’t work

- Offers peace of mind

- Protects your legacy