So far in 2022 we have been hearing a lot about investment risks in both the general and financial press. Investing in any assets, even cash has a degree of risk, as the value of all assets changes over time, even cash in real terms. Gaining an understanding of investment risks and when it is appropriate to accept risk for the opportunity of future gains is a good way to set yourself up for success when investing.

There are many moving parts to consider when it comes to Investment Risk and how best to manage this, so we have split this article into 3 separate features. In this first article of the series, we help you identify the risks of investing, in part 2 we discuss why you need to consider your risk capacity and why you might accept investment risk and in part 3, note some of the key strategies to manage risk.

Identifying Risks

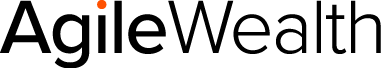

Most people are investors, even without realising it. As a minimum you probably have superannuation, so to set yourself up for success you need to be aware of the fundamental risks when investing. So, what is investment risk? Many of us are aware that investments like shares change in value every day, cash is generally a stable way to hold money and property in Australia has been the source of a lot of family wealth creation and contrary to popular belief is not a linear guarantee. When it comes to risk, there is always a trade-off as there is an interdependent relationship between risk and returns. Therefore understanding some of the basic elements of investment risks is a good way to start in determining if you can accept the risks involved in any form of investment. The below diagram from www.moneysmart.gov.au highlights the relationship of traditional investment assets and risk.

What are the main investment risks?

Below is a table from moneysmart.gov.au that outlines the main risks when investing, and you can see there are a lot of them. Different risks can play out at different times, so it’s important to have a good understanding of these risks or seek professional financial advice to help you.

| Interest rate risk | Interest rate changes reduce your returns or cause you to lose money. This is a key risk for fixed interest investments. |

| Market risk | An investment falls in value because of economic changes or other events that affect the entire market. |

| Sector risk | An investment falls in value because of events that affect a specific industry sector. |

| Currency risk | Currency movements impact your investment and returns. This is a key risk for overseas investments, Australian companies with overseas operations and investments that have foreign currency in them. |

| Liquidity risk | You can’t sell your investment and get your money when you need to without impacting the price in the market. |

| Credit risk | A company or government you lend to will default on the debt and be unable to make the repayments. |

| Concentration risk | If your investments aren’t diversified, poor performance in one investment or asset class can significantly affect your portfolio. |

| Inflation risk | The value of your investments doesn’t keep pace with inflation. |

| Timing risk | The timing of your investment decisions expose you to lower returns or loss of capital. |

| Gearing risk | Using borrowed money to invest can magnify your losses. Your investments may fall in value but you still have to pay the remaining loan balance and interest. |

Whilst Investment Risk is ever-present and has been since the formation of modern economies, we’ll focus on a couple of key areas that are very relevant right now.

1. Market Risk.

The situation in Ukraine is fast-moving and will likely play out over a prolonged period. Unexpected external influences on your investments such as geopolitical issues and in this extreme, war, highlight the need for calm and having a clear objective and sufficient timeframe for your investment goals. To make sure your investments are aligned with your objectives we strongly suggest seeking professional financial advice.

For more information on market risk, respected economist Dr Shane Oliver provides some insights to keep in mind. Read Oliver’s Insights here.

2. Interest Rate Risk.

Over the years and decades, there are shifts in fiscal policy and monetary policy.

– Fiscal Policy is simply government spending (money out) versus tax (money in), just like your own balancing of budgets, living and lifestyle spending versus your wages and other income. There is a fair bit more complexity behind fiscal policies, however, the key takes away here is that governments can influence interest rates, although they don’t set them. The central bank does.

– Monetary Policy is central bank management of interest rates.

We have seen in the last decade, in particular, government (fiscal) stimulus and monetary policies, taking interest rates close to zero. This has created a very supportive environment for growth of certain assets, particularly shares and property. Notwithstanding the situation in Ukraine, interest rate rises around the world do not look to be far away and have already started in some markets. As rates rise, there is a reasonable likelihood of some resetting of valuations for some assets. As valuation adjustments are not likely to be even, we suggest you seek professional advice to check your portfolio’s risk.

3. Inflation Risk.

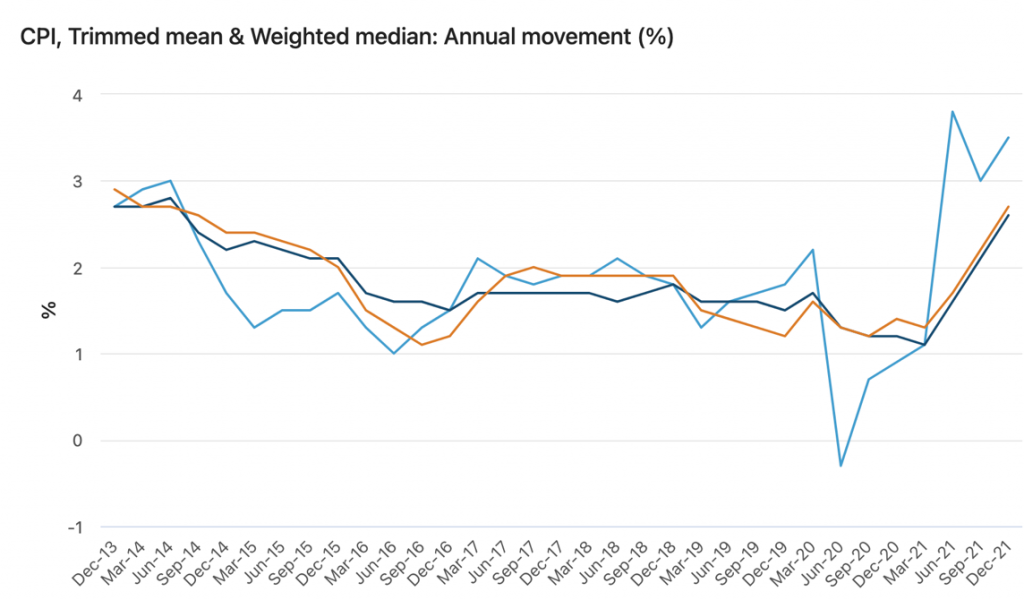

The below chart from www.abs.gov.au shows Pre-COVID, inflation has been low and quite dormant for a number of years. COVID caused a shock impact to economies and inflation fell even further. However, inflation has been increasing and there was a fair bit of commentary from economists and governments on inflation in 2021 being what they described as transitionary as supply chain issues created havoc in the supply versus demand of goods and manufacturing inputs. However, inflation has been stubborn and is something to keep an eye on as one of the reasons we invest is to protect our money from inflation impacts so we retain the real capital value or purchasing power of our money. Inflation could become a key driver for interest rates rising and this may have an increased risk impact on certain assets, in addition to household cash flow risks inflation can cause.

For more insights into Inflation Risk, Dr Shane Oliver explains more here

This article scratches the surface on identifying investment risks. It is important to seek qualified professional financial advice:

– When setting out on an investment journey

– When seeking to build on what you already have

– When the time may have come to apply prudence and stewardship and play a more defensive game to protect capital

General Advice Warning: The information in this communication is provided for information purposes and is of a general nature only. It is not intended to be and does not constitute financial advice or any other advice. Further, the information is not based on your personal objectives, financial situation or needs. You are encouraged to consult a financial planner before making any decision as to how appropriate this information is to your objectives, financial situation and needs. Also, before making a decision, you should consider the relevant Product Disclosure Statement available from your financial planner.

Whilst we have provided some links in this article to insights by AMP’s chief economist Dr Shane Oliver, this is not an endorsement in any way for AMP financial products or services. We have no affiliation with AMP. Dr Oliver provides some easy-to-read insights and greater details on relevant risks we discuss in this article.